Morgan Stanley

Wealth Management Intern

January 2015 - October 2015

Morgan Stanley is a financial services corporation operating in forty-two countries that focuses on financial planning, wealth management, investment banking, stock analysis, and sustainable investing for businesses and individuals.

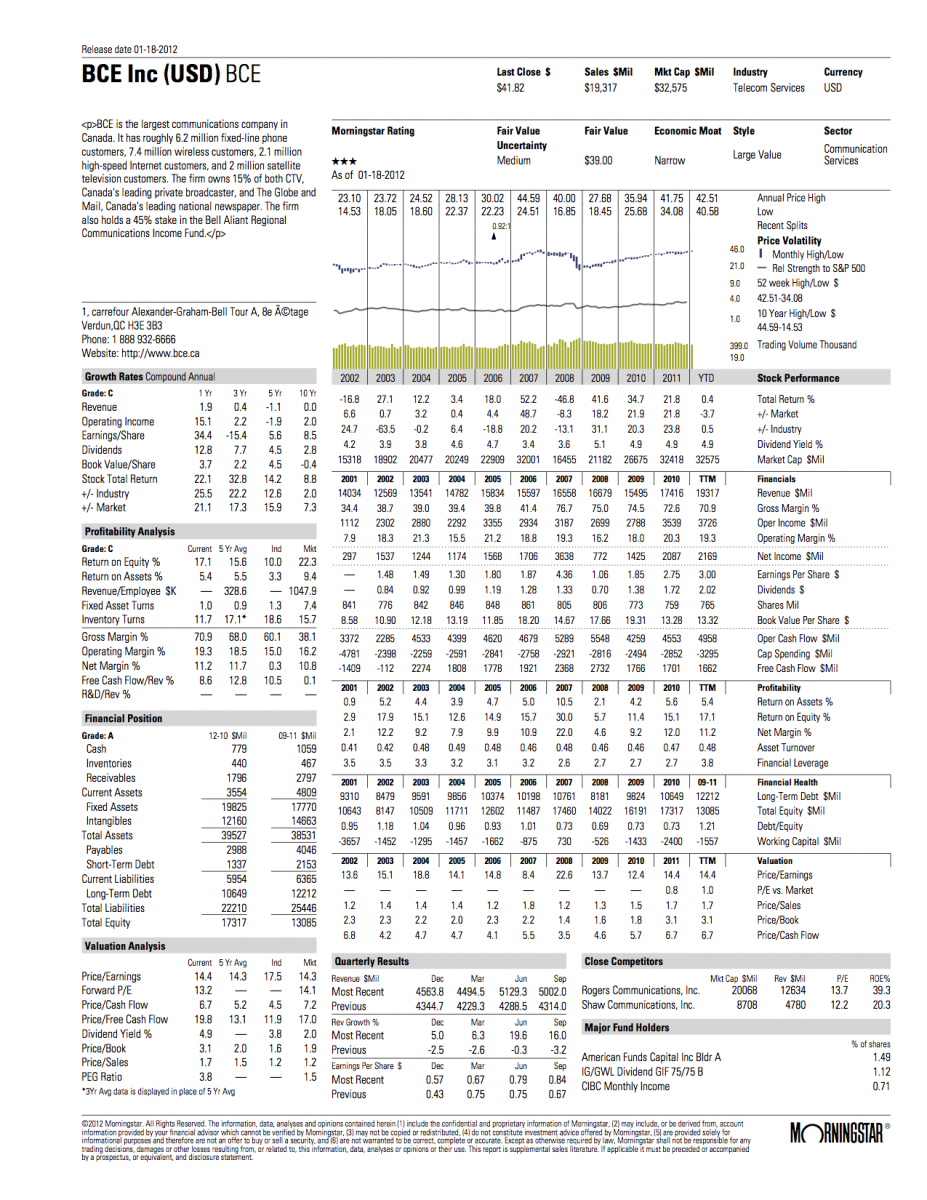

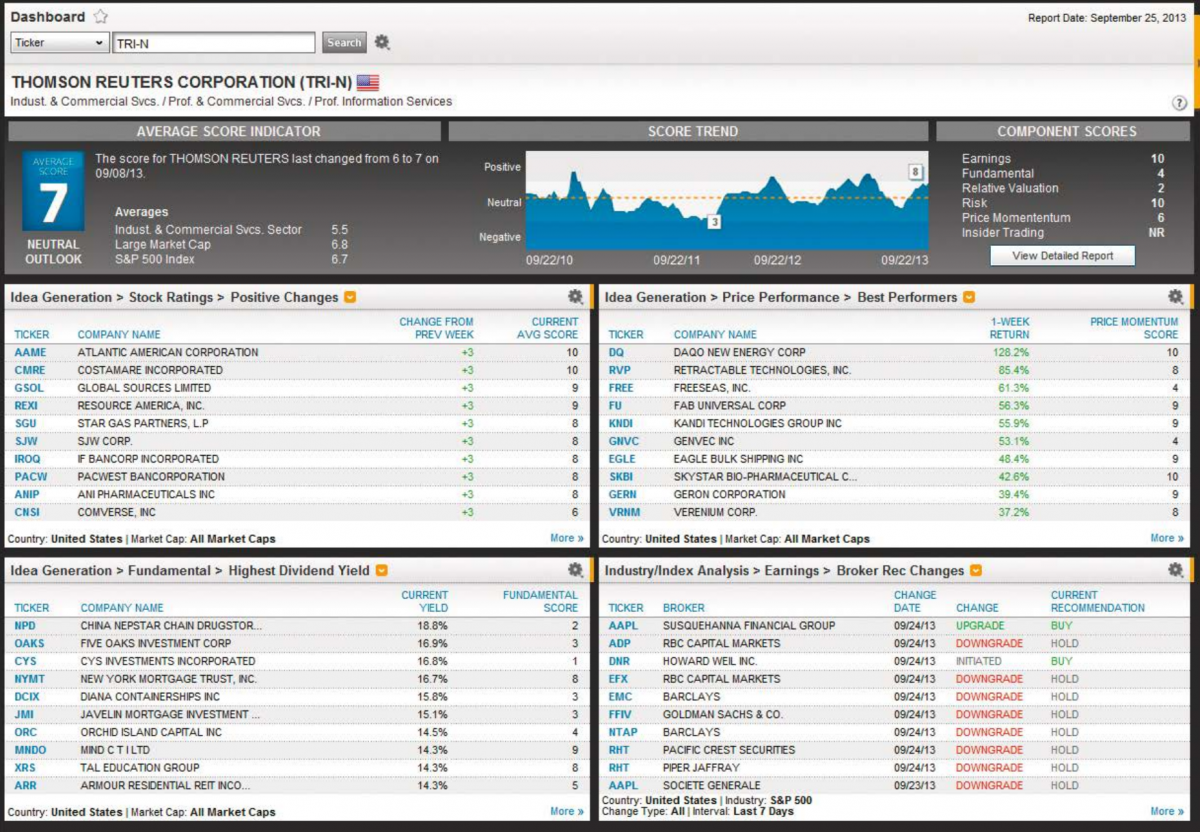

As a Wealth Management Intern, I maintained and inputted data into a multi-factor stock analysis spreadsheet with roughly 130 values and formulas combined for over 500 stocks. This stock watch list database was used for predicting future stock values, and after updating these data points and variables that affected the stock price, I created side-by-side analysis reports on stocks and sectors to recommend investments to my financial advisors.

Initially, I came into this internship solely as a stock research intern. Outside of my internship, I spent a significant amount of time on sites such as Investopedia to gain a deeper understanding of wealth management, stock analysis, and financial planning. This gave me so much more power and control in my responsibilities, and the ability to easily explain processes to other interns!

What I loved most about this internship was the wealth of knowledge I had access to–S&P 500 reports, the Morningstar database, and Morgan Stanley analyst opinions. In between projects, I had the wonderful opportunity to read in-depth about analyst opinions on topics such as Tesla's Powerwall and Allergan's work on CRISPR long before they reached consumer media outlets.

| -

-

Constructing Client

Reports

and Investment

Recommendations

-

-

-

|

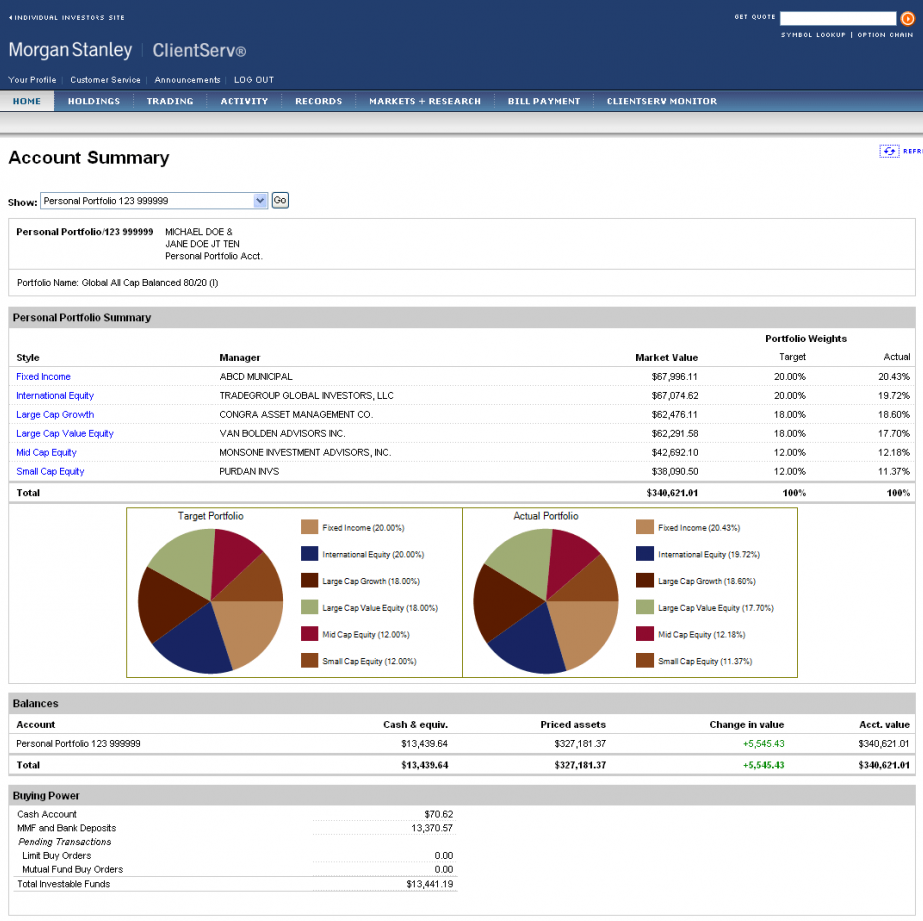

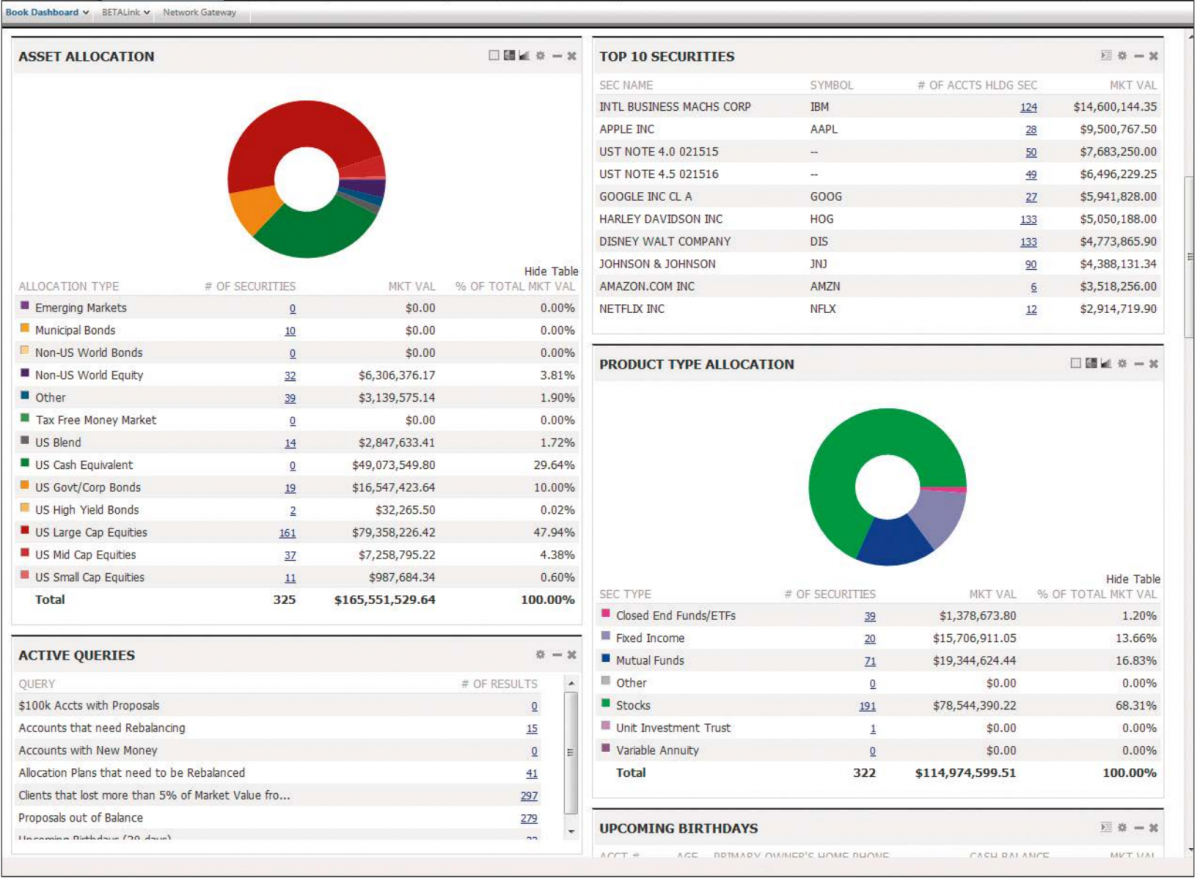

I was able to apply my stock analysis knowledge to each client portfolio as I built their quarterly earnings reports. Although I'm no financial advisor, nor received the training financial advisors undergo, I was able to experience pieces of their day-to-day work for clients! I came to learn that when it comes to deciding on stocks or funds to invest in, there are more factors to consider such their current career and life stage, how aggressive they're willing to be in their investments, and how to recognize if a stock is over or undervalued. |

|

When creating client quarterly earnings reports, I determined which benchmarks best fit each unique portfolio. To see trends within age groups, career types, and businesses in their allocated cash, equities, and fixed income was an interesting insight to take note of, and made me appreciate financial advisors so much more than robo-advisors that are rising in popularity today. |

-

Future Interns

-

Without an intern manual, I struggled during my first month to learn each program used for stock research and reporting. So, I felt compelled to create one for future interns so they would always have something to refer to and streamline their training.

For my final independent project before my leave, I wrote a comprehensive intern manual of over 4,400 words to explain processes, have shorthand cheat sheets for them to refer to, and to demonstrate my full understanding of investing and wealth management.

Images were obtained from publicly available sources such as official company and software websites, as I cannot share data nor client information from this internship.

-

Next experience.

-